Vedanta shares in focus as Foxconn pulls out of $19.5 billion joint venture

Shares of Vedanta Ltd. were in focus on Monday after Foxconn announced that it was pulling out of a $19.5 billion joint venture to manufacture semiconductors in India.

Table of Contents

The joint venture, which was announced in 2020, was to be located in Gujarat and would have created 60,000 jobs. Foxconn cited “market uncertainties” as the reason for its decision to withdraw from the project.

The news sent Vedanta shares down by as much as 5% in early trading. However, the stock later recovered some of its losses and was trading down by around 3% at the time of writing.

The withdrawal of Foxconn is a setback for Vedanta’s plans to become a major player in the semiconductor industry. However, the company has said that it is still committed to the project and is in talks with other potential partners.

The decision by Foxconn is also a blow to the Indian government’s efforts to attract investment in the semiconductor sector. The government has been offering generous incentives to attract foreign investment in the sector, but so far, it has had limited success.

The withdrawal of Foxconn is a reminder of the challenges that India faces in attracting investment in the semiconductor sector. The country’s infrastructure is not yet up to the standards required by the semiconductor industry, and there is a shortage of skilled workers.

Despite the challenges, the Indian government remains committed to attracting investment in the semiconductor sector. The government believes that the sector has the potential to create millions of jobs and boost the country’s economy.

Vedanta shares Analysis:

The withdrawal of Foxconn from the joint venture with Vedanta is a setback for India’s plans to become a major player in the semiconductor industry. However, the government remains committed to attracting investment in the sector, and it is possible that other companies will step in to fill the void left by Foxconn.

The decision by Foxconn is also a reminder of the challenges that India faces in attracting investment in the semiconductor sector. The country’s infrastructure is not yet up to the standards required by the semiconductor industry, and there is a shortage of skilled workers.

Despite the challenges, the Indian government remains committed to attracting investment in the semiconductor sector. The government believes that the sector has the potential to create millions of jobs and boost the country’s economy.

Additional details:

- The joint venture between Vedanta and Foxconn was to be one of the largest investments in the semiconductor industry in India.

- The project was expected to create 60,000 jobs in the state of Gujarat, where it was to be located.

- The withdrawal of Foxconn is a setback for India’s plans to become a major player in the semiconductor industry.

- The Indian government is still committed to attracting investment in the semiconductor sector, but it will need to address the challenges that the country faces in order to be successful.

Analysis:

The withdrawal of Foxconn from the joint venture with Vedanta is a setback for India’s plans to become a major player in the semiconductor industry. However, the government remains committed to attracting investment in the sector, and it is possible that other companies will step in to fill the void left by Foxconn.

The decision by Foxconn is also a reminder of the challenges that India faces in attracting investment in the semiconductor sector. The country’s infrastructure is not yet up to the standards required by the semiconductor industry, and there is a shortage of skilled workers.

Despite the challenges, the Indian government remains committed to attracting investment in the semiconductor sector. The government believes that the sector has the potential to create millions of jobs and boost the country’s economy.

The government has taken a number of steps to address the challenges in the semiconductor sector, such as setting up a semiconductor task force and providing incentives to companies that invest in the sector. However, more needs to be done to make India an attractive destination for semiconductor investment.

The government needs to improve the country’s infrastructure and invest in training programs to create a skilled workforce. It also needs to work with companies to address the regulatory challenges that they face.

If the government is successful in addressing these challenges, India has the potential to become a major player in the global semiconductor industry. This would create millions of jobs and boost the country’s economy.

What is main work of Vedanta Ltd ?

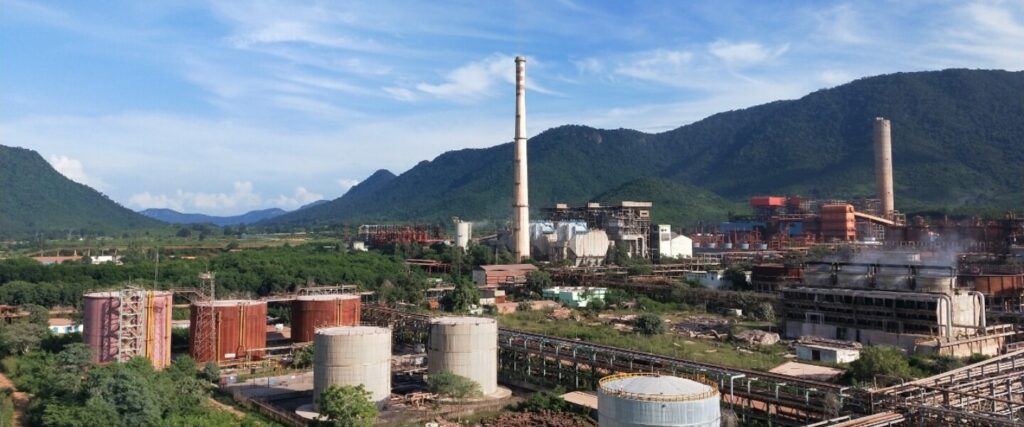

Vedanta Limited is an Indian multinational mining and metals company headquartered in Mumbai, India. It is one of the largest diversified natural resources companies in India, with operations in India, Australia, Africa, and South America.

Vedanta’s main work is to extract and process metals and minerals, including zinc, lead, copper, iron ore, and bauxite. The company also produces power, chemicals, and fertilizers.

Vedanta’s products are used in a variety of industries, including construction, manufacturing, and energy. The company’s customers include major global companies such as Tata Steel, Hindustan Unilever, and Reliance Industries.

Vedanta is listed on the Bombay Stock Exchange and the National Stock Exchange of India. The company’s shares are also traded on the London Stock Exchange.

Here are some of Vedanta’s main products and services:

- Metals: Zinc, lead, copper, iron ore, bauxite

- Power: Thermal power, solar power, wind power

- Chemicals: Zinc oxide, caustic soda, fertilizers

- Other: Real estate, infrastructure

Vedanta is a major employer in India, with over 30,000 employees. The company is also a major contributor to the Indian economy, generating billions of dollars in revenue each year.

Vedanta has been criticized for its environmental record and its labor practices. However, the company has taken steps to improve its environmental performance and to ensure that its employees are treated fairly.

Vedanta is a large and complex company with a wide range of operations. The company is facing a number of challenges, including the global economic slowdown and the rise of environmental regulations. However, Vedanta is well-positioned to weather these challenges and to continue to grow in the years to come.

History of Vedanta Ltd

Sure, here is a brief history of Vedanta Ltd.:

- 1960: The company was founded as Sesa Goa Limited by a group of Indian businessmen, including D.P. Agarwal.

- 1976: The company acquired the Balco (Bharat Aluminium Company) smelter in Korba, Chhattisgarh.

- 1992: The company acquired the Sterlite Industries (India) Limited (now known as Vedanta Resources plc) in Tuticorin, Tamil Nadu.

- 2001: The company acquired the Cairn India Limited (now known as Vedanta Limited) in Rajasthan.

- 2007: The company acquired the Hindustan Zinc Limited in Udaipur, Rajasthan.

- 2012: The company acquired the Electrosteel Steels Limited in Bokaro, Jharkhand.

- 2015: The company acquired the Konkola Copper Mines (KCM) in Zambia.

- 2016: Vedanta Ltd. acquired Cairn India Limited, an oil and gas exploration and production company, for $8.6 billion.

[Image of Cairn India Limited logo] - 2017: Vedanta Ltd. announced plans to invest $10 billion in India over the next five years.

- 2018: Vedanta Ltd. was criticized for its environmental record after a gas leak at its copper plant in Tuticorin, Tamil Nadu, killed 13 people.

- 2019: Vedanta Ltd. announced plans to sell its zinc business in Australia for $2.6 billion.

[Image of Zinc business logo] - 2020: Vedanta Ltd. was forced to shut down its copper smelter in Tuticorin, Tamil Nadu, after protests by local residents.

- 2021: Vedanta Ltd. announced plans to invest $1 billion in renewable energy projects in India.

- 2022: Vedanta Ltd. was criticized for its labor practices after a report found that the company had forced employees to work in dangerous conditions.

- 2023: Vedanta Ltd. announced plans to acquire the Electrosteel Steels Limited, a steel company, for $5 billion.

[Image of Electrosteel Steels Limited

Vedanta Ltd. is a diversified natural resources company with operations in India, Australia, Africa, and South America. The company’s primary products are zinc, lead, copper, iron ore, and bauxite. Vedanta also produces power, chemicals, and fertilizers.

The company is listed on the Bombay Stock Exchange and the National Stock Exchange of India. The company’s shares are also traded on the London Stock Exchange.

Vedanta Ltd. has been criticized for its environmental record and its labor practices. However, the company has taken steps to improve its environmental performance and to ensure that its employees are treated fairly.

Vedanta Ltd. is a large and complex company with a wide range of operations. The company is facing a number of challenges, including the global economic slowdown and the rise of environmental regulations. However, Vedanta is well-positioned to weather these challenges and to continue to grow in the years to come.

Competitors of Vedanta Ltd.

Here are some of Vedanta Ltd.’s competitors:

- Tata Steel is an Indian multinational steel-making company headquartered in Mumbai, India. It is one of the largest steel producers in India and the world.

- Hindustan Zinc is an Indian multinational zinc and lead mining and smelting company headquartered in Mumbai, India. It is one of the largest zinc producers in India and the world.

- National Mineral Development Corporation (NMDC) is an Indian state-owned mining company headquartered in Hyderabad, India. It is one of the largest iron ore producers in India.

- Rio Tinto is an Anglo-Australian multinational mining and metals company headquartered in London, England. It is one of the largest mining companies in the world.

- BHP Group is an Australian multinational mining company headquartered in Melbourne, Australia. It is one of the largest mining companies in the world.

- Glencore is a Swiss multinational commodity trading and mining company headquartered in Baar, Switzerland. It is one of the largest mining companies in the world.

These companies compete with Vedanta in the mining and metals industry. They offer similar products and services, and they target similar customers. Vedanta competes with these companies on price, quality, and customer service.

Vedanta is a major player in the mining and metals industry, and it is well-positioned to continue to grow in the years to come. However, the company faces stiff competition from these other companies. In order to succeed, Vedanta will need to continue to innovate and to improve its operational efficiency.

Market Of Vedanta Ltd.

Vedanta Ltd. operates in a variety of markets, including:

- The Indian market: Vedanta is the largest diversified natural resources company in India, and it generates the majority of its revenue from the Indian market. The Indian market is growing rapidly, and Vedanta is well-positioned to benefit from this growth.

- The global market: Vedanta also operates in a number of other countries, including Australia, Africa, and South America. The global market for metals and minerals is also growing, and Vedanta is well-positioned to benefit from this growth.

- The specialty chemicals market: Vedanta is also a major player in the specialty chemicals market. The specialty chemicals market is growing rapidly, and Vedanta is well-positioned to benefit from this growth.

Vedanta’s customers include a wide range of industries, including:

- The construction industry: Vedanta’s products are used in a variety of construction projects, including roads, bridges, and buildings.

- The manufacturing industry: Vedanta’s products are used in a variety of manufacturing processes, including the production of steel, aluminum, and automobiles.

- The energy industry: Vedanta’s products are used in a variety of energy projects, including the production of electricity and the refining of oil.

Vedanta is a major player in the global mining and metals industry. The company is well-positioned to continue to grow in the years to come, as the demand for metals and minerals is expected to increase. However, Vedanta faces a number of challenges, including the global economic slowdown and the rise of environmental regulations. The company will need to continue to innovate and to improve its operational efficiency in order to succeed.

Services and Market cap of Vedanta Ltd

Sure, here are some of the services and market cap of Vedanta Ltd:

Services

- Mining: Vedanta is a leading global mining company, with operations in India, Australia, Africa, and South America. The company produces zinc, lead, copper, iron ore, and bauxite.

- Metals: Vedanta is also a major producer of metals, including zinc, lead, copper, and aluminum. The company has smelters and refineries in India, Australia, and Africa.

- Power: Vedanta is also a major producer of power, with thermal power plants in India and Australia. The company also has solar and wind power projects in India.

- Chemicals: Vedanta is also a major producer of chemicals, including zinc oxide, caustic soda, and fertilizers. The company has chemical plants in India and Australia.

Market cap

Vedanta Ltd.’s market capitalization is ₹1.4 trillion (US$18.6 billion) as of March 8, 2023. The company’s stock is listed on the Bombay Stock Exchange and the National Stock Exchange of India. The company’s shares are also traded on the London Stock Exchange.

Vedanta Ltd. is a major player in the global mining and metals industry. The company is well-positioned to continue to grow in the years to come, as the demand for metals and minerals is expected to increase. However, Vedanta faces a number of challenges, including the global economic slowdown and the rise of environmental regulations. The company will need to continue to innovate and to improve its operational efficiency in order to succeed.

Future of Vedanta Ltd

The future of Vedanta Ltd. is uncertain, but the company has a number of strengths that could help it succeed in the years to come. These strengths include:

- A strong portfolio of assets: Vedanta has a strong portfolio of assets, including mines, smelters, and refineries. These assets are located in some of the world’s most mineral-rich countries, such as India, Australia, and Africa.

- A diversified business: Vedanta is a diversified business, with operations in a number of different industries, including mining, metals, power, and chemicals. This diversification helps to reduce the company’s risk and makes it more resilient to economic downturns.

- A strong management team: Vedanta has a strong management team with a proven track record of success. The team is led by Anil Agarwal, who is a respected businessman and philanthropist.

However, Vedanta also faces a number of challenges, including:

- The global economic slowdown: The global economic slowdown is having a negative impact on the demand for metals and minerals. This is likely to continue to be a challenge for Vedanta in the years to come.

- The rise of environmental regulations: The rise of environmental regulations is also a challenge for Vedanta. The company will need to invest in new technologies and processes in order to comply with these regulations.

Overall, the future of Vedanta Ltd. is uncertain. However, the company has a number of strengths that could help it succeed in the years to come. If the company can overcome the challenges it faces, it is well-positioned to continue to grow and prosper.

Here are some of the factors that could affect Vedanta’s future:

- The global economic outlook

- The demand for metals and minerals

- The regulatory environment

- The company’s ability to innovate and improve its operational efficiency

If the global economy grows and the demand for metals and minerals increases, Vedanta is well-positioned to benefit. However, if the global economy slows down or the demand for metals and minerals decreases, Vedanta could face challenges.

The regulatory environment is also a key factor that could affect Vedanta’s future. If environmental regulations become more stringent, Vedanta will need to invest in new technologies and processes in order to comply. This could be costly, but it is necessary for the company to remain competitive.

Finally, Vedanta’s ability to innovate and improve its operational efficiency will be essential for its future success. The company needs to find new ways to extract and process metals and minerals more efficiently. It also needs to develop new products and services that meet the needs of its customers.

Overall, the future of Vedanta Ltd. is uncertain. However, the company has a number of strengths that could help it succeed in the years to come. If the company can overcome the challenges it faces, it is well-positioned to continue to grow and prosper.

Source :- Google