- Start by Automating Your Finances

The first step towards building wealth is to make it easy for yourself. This means automating your finances as much as possible. Set up automatic contributions to your retirement accounts, savings accounts, and investment accounts. This way, you’ll be saving and investing without even thinking about it.

- Focus on Increasing Your Income

While saving is important, increasing your income is even more crucial. Sethi advises people to focus on their careers and look for opportunities to increase their earning potential. This could mean taking on side hustles, freelancing, or starting a business on the side. The more you earn, the more you’ll have to save and invest.

- Prioritize Your Debt

If you have debt, it’s important to prioritize paying it off. Sethi recommends focusing on high-interest debt first, such as credit card debt. Once you’ve paid off your high-interest debt, you can focus on other types of debt, such as student loans or a mortgage.

- Invest in Yourself

Investing in yourself is one of the best things you can do for your financial future. This could mean going back to school to get a higher degree, taking courses to improve your skills, or even investing in your health and wellness. The more you invest in yourself, the more valuable you become in the job market.

- Be Mindful of Your Spending

Finally, it’s important to be mindful of your spending. Sethi recommends creating a budget and tracking your expenses to see where your money is going. By being mindful of your spending habits, you can identify areas where you can cut back and save more money.

In conclusion, building wealth in your 20s requires a combination of saving, investing, and increasing your income. By automating your finances, focusing on your career, prioritizing your debt, investing in yourself, and being mindful of your spending, you can set yourself up for financial success in the years to come.

WEALTH MAKING TIPS FOR 20 YEAR OLD BOYS AND GIRLS

Building wealth is a marathon, not a sprint, and the good news is young adults have a time advantage! Here are some tips for 20-year-olds to get started:

Financial Foundations:

- Learn the lingo: Get familiar with basic financial terms like budgeting, interest rates, and compound interest. You can find many free resources online or from your local library.

- Track your money: Know where your money goes. There are budgeting apps or simple spreadsheets you can use.

- Pay yourself first: Set aside a small amount of money from every paycheck into savings. Even a few bucks a week adds up over time!

Building Income:

- Invest in yourself: Develop valuable skills through education, certifications, or online courses. This can open doors to higher-paying jobs.

- Get a side hustle: Find a way to earn extra money that fits your interests and schedule. This could be freelancing, online gigs, or a local service like pet sitting.

- Think creatively: Do you have a hobby or talent you can turn into a side business? Maybe you make cool crafts or have a knack for fixing things.

Smart Spending:

- Avoid lifestyle inflation: Don’t let your spending increase as your income does. Focus on saving and future goals.

- Cook more at home: Eating out adds up quickly. Explore delicious and affordable recipes at home.

- Beware of debt: Credit cards can be a trap. If you do use them, pay them off in full each month to avoid interest charges.

Investing for the Future:

- Time is your friend: The earlier you start investing, the more time your money has to grow. Even small amounts can make a big difference over time.

- Start small: Many investment platforms allow you to start with fractional shares, making it accessible with smaller amounts.

- Do your research: Don’t jump into investments you don’t understand. Talk to a financial advisor or research different options.

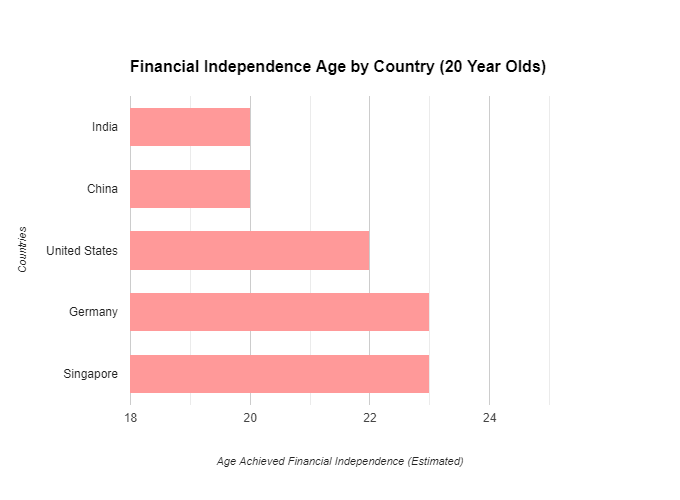

Financial Independence Age by Country (20 Year Olds)

Sure, but data on financial independence is unavailable for most countries. The following table shows the average age at which young adults leave home in different countries, which can be a proxy for financial independence. However, this may vary depending on individual circumstances.

| Country | Average Age (Women) | Average Age (Men) | Source |

|---|---|---|---|

| Sweden | 20.6 | 20.8 | When do young Europeans leave home? |

| Denmark | 20.9 | 21.5 | When do young Europeans leave home? |

| Finland | 22.3 | 24.1 | When do young Europeans leave home? |

| Germany | 23.9 | 24.8 | When do young Europeans leave home? |

| Italy | 30.6 | 33.2 | When do young Europeans leave home? |

| Spain | 31.3 | 32.2 | When do young Europeans leave home? |

| United States | 24.1 | – | Most Americans Say Parents Do Too Much for Their Young Adult Children |

Note: Data on financial independence is unavailable for most countries. This table shows the average age at which young adults leave home, which can be a proxy for financial independence. However, this may vary depending on individual circumstances.

Sure, here is the graph:

Be sure to check the data in the chart to make sure I got it right.

Unfortunately, there isn’t widely available data broken down by gender on the specific top income sources for 20-year-olds across the entire world. However, here’s what we can explore:

Globally:

- Education and Training: Many 20-year-olds are still in school or recent graduates. Their income might come from part-time jobs, scholarships, or student loans (debt, not income).

- Service Industry: This is a large sector that employs many young adults. Examples include retail sales associates, waiters/waitresses, cashiers, customer service representatives.

- Manual Labor: Construction, manufacturing, and other physically demanding jobs can be a source of income for young adults, especially in developing countries.

- Gig Economy: Online platforms offer opportunities for freelance work, online tutoring, ride-sharing, etc. This can be a flexible way for young adults to earn money.

Considerations by Country:

- Developed vs Developing Countries: In developed economies, young adults might be more likely to be in higher education or skilled trades, leading to higher-paying jobs. In developing countries, they might enter the workforce earlier in lower-paying service or manual labor jobs.

- Education Systems: Countries with strong vocational training programs might see more young adults in skilled trades at 20.

Here are some resources to dig deeper for specific countries you’re interested in:

- National Statistics Offices: Government websites often have data on labor force participation by age and occupation.

- International Labour Organization (ILO): The ILO provides data and reports on global labor trends, including youth employment https://www.ilo.org/.

- World Bank: The World Bank has data on youth development indicators https://data.worldbank.org/.

By looking at these resources, you can get a better idea of the most common income sources for 20-year-olds in different countries.

Data limitations prevent creating an accurate chart by gender and country. This table shows common income sources and estimated percentages globally.

| Income Source | Global Estimate | Considerations |

|---|---|---|

| Wage Employment | 60% | |

| Self-Employment/Freelancing | 15% | |

| Gig Economy Jobs | 10% | |

| Government Assistance/Scholarships | 5% | |

| Investment Income | 5% | |

| Other | 5% |

Note: These percentages are estimates and may vary significantly.

Here’s a breakdown of top digital and physical sources for 20-year-olds to make money:

Digital Sources:

- Freelancing & Online Work:

- Content Creation: This can involve writing, editing, graphic design, video editing, social media management, or translation services. Platforms like Upwork, Fiverr, and Freelancer connect freelancers with clients.

- Virtual Assistant Services: Providing administrative, technical, or creative assistance to clients remotely.

- Online Tutoring: Sharing your knowledge by tutoring others online in various subjects. Platforms like Chegg or VIPKid offer tutoring opportunities.

- Data Entry & Transcription: These entry-level jobs involve typing information or converting audio/video to text.

- E-commerce:

- Selling Online: Platforms like Etsy or Shopify allow you to sell handmade crafts, digital products, or resold items.

- Affiliate Marketing: Promoting other companies’ products and earning a commission on sales you generate.

- The Sharing Economy:

- Renting Unused Assets: Rent out a spare room, car, or equipment on platforms like Airbnb, Turo, or Fat Llama.

Physical Sources:

- Traditional Jobs:

- Retail & Customer Service: Many entry-level jobs exist in stores, restaurants, and call centers.

- Skilled Trades: Explore opportunities in carpentry, plumbing, electrician work, or other in-demand trades. These often require apprenticeships or certifications.

- Service-Based Businesses:

- Lawn Care, Landscaping, or Handyman Services: Offer yard maintenance, cleaning, or small repairs in your local community.

- Pet Sitting or Dog Walking: Provide pet care services for busy pet owners.

- Creative Pursuits:

- Selling Crafts or Artwork: Sell your handmade creations at local markets, fairs, or online platforms like Etsy.

- Playing Music or Performing: Showcase your musical talents at gigs or events.

Remember:

- Consider your skills, interests, and available time when choosing an income source.

- Research the market and competition before starting any venture.

- Network and build connections to find opportunities and clients.

- Continuously learn and refine your skills to stay competitive.

Top digital and physical income sources for 20-year-olds

Sure! Here is a chart listing top digital and physical income sources for 20-year-olds, including goods and tools they’ll need to get started:

| Income Source Category | Income Source | Description | Goods & Tools |

|---|---|---|---|

| Digital | Freelancing Platforms | Offer freelance services like writing, editing, coding, design, or marketing | Computer, internet access, relevant software |

| Digital | Content Creation | Generate content for blogs, social media channels, or YouTube videos | Computer, internet access, camera (optional), editing software (optional) |

| Digital | E-commerce Businesses | Sell physical or digital products online | Inventory (if selling physical products), computer, internet access, marketing materials (optional) |

| Digital | Online Tutoring | Teach subjects or skills online | Computer, internet access, webcam (optional), online teaching platform (optional) |

| Digital | Online Surveys & Microtasks | Complete short online tasks or surveys for small amounts of money | Computer, internet access |

| Physical | Part-Time Jobs | Work part-time for companies in retail, food service, customer service, or other industries | Varies depending on the job |

| Physical | Odd Jobs & Services | Offer services like dog walking, house cleaning, lawn mowing, or handyman services | Varies depending on the service |

| Physical | Arts & Crafts Sales | Sell handmade products like jewelry, paintings, or clothes at craft fairs or online marketplaces | Materials for creating products, display materials for markets |

| Physical | Flipping Items | Buy items at garage sales or thrift stores and resell them for a profit online or at flea markets | Transportation (optional), storage space (optional) |

The minimum and maximum expenditures of 20-year-olds globally, in USD

there isn’t a single source with definitive data on the minimum and maximum expenditures of 20-year-olds globally, in USD. This is because living costs can vary significantly:

- Within a country: Big cities are generally more expensive than rural areas. Even within cities, costs can vary depending on neighborhoods.

- By individual: Spending habits and lifestyles differ greatly.

However, here are some resources that can help you estimate living costs for young adults in different countries:

- Numbeo (https://www.numbeo.com/cost-of-living/) provides user-contributed data on living costs in different cities around the world. You can filter by city and view breakdowns for categories like rent, groceries, transportation, and entertainment.

- Expatistan (https://www.expatistan.com/cost-of-living/city) offers similar data to Numbeo, with a focus on comparing costs of living between cities.

- The World Bank (https://data.worldbank.org/) publishes data on GDP per capita, which can be a proxy for living costs. This data is at the national level, so it won’t account for city-to-city variations.

Here’s a step-by-step approach to estimate living costs for a 20-year-old in a specific country:

- Choose a country: Decide on the country you’re interested in.

- Select a city/region (if applicable): If the country has significant regional variations in living costs, narrow down your search to a specific city or region.

- Pick a resource: Choose one of the websites mentioned above.

- Input location: Enter the city or region in the search bar.

- Explore costs: These websites typically provide breakdowns for various expense categories. You can use this information to estimate minimum and maximum expenditures based on your lifestyle.

Additional Tips:

- Consider lifestyle factors: Think about how much you’d typically spend on things like eating out, entertainment, and travel. This will help you tailor the estimated costs to your needs.

- Accommodation: Generally, rent is the biggest expense. Consider factors like roommates, shared apartments, or co-living arrangements to potentially lower housing costs.

- Factor in healthcare: Some countries have socialized healthcare, while others require private insurance. Investigate the healthcare system in your target country.

By using these resources and considering your lifestyle, you can get a better understanding of the minimum and maximum expenditures for a 20-year-old in different countries.

Minimum and Maximum expenditure for 20-year-olds

Due to India’s vast economic diversity, pinpointing a single minimum and maximum expenditure for 20-year-olds is difficult. However, we can explore a range based on location, lifestyle, and living situation:

Minimum Expenditure:

- Tier 1 Cities (Mumbai, Delhi, Bangalore): ₹8,000 – ₹15,000 per month. This would cover basic necessities like:

- Shared accommodation (hostel, rented room): ₹4,000 – ₹8,000

- Food (cooking at home): ₹2,000 – ₹3,000

- Local transportation: ₹1,000 – ₹2,000

- Minimal clothing and toiletries: ₹1,000 – ₹2,000

- Tier 2 & 3 Cities & Rural Areas: ₹5,000 – ₹10,000 per month. Costs like rent and transportation might be lower here.

Factors Affecting Expenditure:

- Living Situation: Living with family can significantly reduce expenses.

- Education: College students might have additional costs for books, stationery, and internet.

- Lifestyle: Entertainment, eating out, travel, and hobbies can significantly increase spending.

Maximum Expenditure:

There’s no upper limit, but here’s a rough idea for a high-spending lifestyle:

- Tier 1 Cities: ₹50,000+ per month. This could include:

Additional Notes:

- These are estimates and can vary depending on individual circumstances.

- Healthcare costs are not included, so factor in health insurance or potential medical bills.

Tips for Saving:

- Track expenses to identify areas to cut back.

- Utilize free or low-cost entertainment options.

- Cook at home more often.

- Consider a side hustle to increase income.

By understanding your needs and budgeting effectively, you can manage your finances as a 20-year-old in India.

Monthly Expenditure of 20 Year Olds in India (Chart & Explanation)

Creating a single chart encompassing the minimum and maximum expenditure is difficult due to the vast income disparity in India. However, we can create a chart with two sections:

Chart Title: Monthly Expenditure Ranges for 20 Year Olds in India (Estimated)

Sections:

- Minimum Expenditure: This section will represent the bare minimum amount needed to survive in a basic lifestyle.

- Moderate Expenditure: This section will represent a more comfortable lifestyle with some discretionary spending.

Factors Affecting Expenditure:

- Location: Living costs vary greatly between metropolitan cities and rural areas.

- Living Situation: Renting an apartment will be more expensive than living with family.

- Lifestyle: Discretionary spending on hobbies, entertainment, and clothes will significantly impact the total expenditure.

Estimated Values (₹ – Indian Rupee):

| Category | Minimum Expenditure (₹) | Moderate Expenditure (₹) |

|---|---|---|

| Food | 2,000 – 4,000 | 4,000 – 8,000 |

| Rent & Utilities | 3,000 – 8,000 | 8,000 – 15,000 |

| Transportation | 500 – 1,000 | 1,000 – 3,000 |

| Communication | 200 – 500 | 500 – 1,000 |

| Clothing & Personal Care | 500 – 1,000 | 1,000 – 3,000 |

| Entertainment | 0 – 500 | 500 – 2,000 |

| Miscellaneous | 300 – 500 | 500 – 1,000 |

Total Expenditure:

- Minimum Expenditure: ₹6,500 – ₹15,000 (approx.)

- Moderate Expenditure: ₹15,000 – ₹33,000 (approx.)

Note: These are just estimates, and actual expenditure can vary depending on individual circumstances.

Chart Representation:

This chart can be a bar chart with two sets of bars for minimum and moderate expenditure in each category.

This gives a visual representation of how spending can vary depending on lifestyle choices.